Wire Transfer

If you wish to fund your account via wire transfer, please contact your account manager or access our live chat to receive the appropriate banking details.

Please note that there is a minimum deposit of €500 for wire transfers.

Your Internet Explorer browser is out of date. For better user experience, we suggest you to start using one of the following browsers: Google Chrome, Firefox Mozilla or Microsoft Edge.

Company Information:

VestoFX is the trade name of EVBX LTD which is registered as a Cyprus Investment Firm (CIF) and licensed by the Cyprus Securities and Exchange Commission (CySEC) under licence number 409/22.

RISK WARNING: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

EVBX LTD applies strict measures in line with anti-spam regulations by avoiding unsolicited advertising. Please read our Privacy Policy document.

EVBX LTD provides services to residents of the European Economic Area (excluding Belgium), India, Indonesia, Malaysia, Philippines and Vietnam.

Here are some key terms commonly used in CFD (Contract for Difference) trading:

Account

A record detailing all transactions within a trading account.

Account Balance

The total amount of funds available in an account.

Appreciation

A currency is said to appreciate when its value increases due to market demand, representing an overall rise in asset value.

Arbitrage

A strategy that involves profiting from price differences in different markets by simultaneously buying and selling an asset in separate locations.

Ask/Offer

The price or rate at which a seller is willing to offer an asset for sale.

Ausie

A common term used to refer to the Australian Dollar (AUD).

Back Office

The administrative division responsible for processing financial transactions, including trade confirmations, settlements, and record-keeping.

Balance of Payments

A comprehensive record of all economic transactions between a country and the rest of the world within a specific time frame, including trade, services, and capital movements.

Balance of Trade

The net difference between a country’s exports and imports.

Bar Chart

A technical analysis tool that visually represents the highest, lowest, opening, and closing prices of a financial instrument within a given time frame.

Base Currency

The primary currency in a currency pair, used as a reference for quotes. In Forex trading, the U.S. Dollar is typically considered the base currency in most quotes.

Basis Point

A unit of measurement equal to one-hundredth of a percentage point (0.01%).

Bear

A trader who expects the market or an asset’s price to decline.

Bear Market

A prolonged period of declining prices, usually accompanied by negative investor sentiment.

Bid

The price at which a buyer is willing to purchase an asset.

Bonds

Debt instruments issued by governments or corporations to raise capital, paying fixed or variable interest, known as a coupon.

Broker

An individual or firm that facilitates transactions between buyers and sellers, typically earning a commission. Unlike a broker, a dealer takes on the financial risk by acting as a counterparty to trades.

Buba

A short term for Deutsche Bundesbank, Germany’s central bank.

Bull

A trader who anticipates rising prices in the market.

Bull Market

A market characterized by sustained price increases and positive investor sentiment.

Candlestick Chart

A charting tool that illustrates price movements, showing the open, close, high, and low prices of an asset over a specific period.

Central Bank

A government or semi-governmental institution responsible for managing a country’s monetary policy and currency issuance, such as the U.S. Federal Reserve (Fed) and the European Central Bank (ECB).

Chartist

A trader who analyzes price charts, historical data, and trends to predict future market movements, also known as a technical trader.

Clearing

The process of finalizing a financial transaction.

Closed Position

A previously open trade that has been exited by taking an equal and opposite position, effectively neutralizing exposure.

Commission

A fee charged by brokers for executing trades on behalf of clients.

Confirmation

A document confirming the details of a completed transaction between trading parties.

Contract

The basic trading unit utilized in financial markets.

Counterparty

The entity, such as a bank or trader, involved in a financial transaction.

Cross Rate

An exchange rate between two currencies that does not involve the domestic currency of the country where the rate is quoted. For example, GBP/CHF would be considered a cross rate in the U.S.

Currency

A government-issued form of money, such as the U.S. Dollar (USD) or Euro (EUR).

Currency Pair

A combination of two currencies forming an exchange rate, such as EUR/USD or GBP/JPY.

Currency Risk

The risk of potential losses due to unfavorable fluctuations in exchange rates.

Day Trading

A trading strategy where positions are opened and closed within the same trading session.

Dealer

An entity that acts as a principal in a trade, assuming financial risk rather than simply acting as an intermediary like a broker.

Deficit

A shortfall in trade or financial transactions where expenses or liabilities exceed income or assets.

Delivery

Delivery refers to the exchange of ownership of the traded currencies between two parties.

Deposit

The lending or borrowing of cash, often at a specified interest rate, known as the deposit rate.

Depreciation

Depreciation refers to a decrease in the value of a currency relative to another due to market factors.

Derivative

A financial instrument that derives its value from an underlying asset, such as options or futures.

Devaluation

A deliberate reduction in a currency’s value, often carried out by a government or central bank.

ECB – European Central Bank

The central bank responsible for monetary policy in the Eurozone.

End of Day (Mark-to-Market)

A method of accounting where open positions are re-evaluated based on current market prices at the end of each trading day.

Euro

The official currency of the Eurozone.

Execution Date

The date on which a trade is executed.

Fed – Federal Reserve

The central bank of the United States, responsible for monetary policy.

Fixed Exchange Rate (Representative Rate)

An exchange rate set by monetary authorities, which remains stable within certain limits.

Flat (Square, Balanced)

A position where there are no outstanding trades, meaning the trader is neither long nor short.

Federal Open Market Committee (FOMC)

The U.S. Federal Reserve committee that oversees monetary policy and interest rate decisions.

Foreign Exchange (Forex or FX)

The global market for trading currencies, involving the simultaneous buying of one currency and selling of another.

Forward Contract

A financial agreement to buy or sell an asset at a predetermined price on a future date.

Forward Points

The additional or subtracted amount used to calculate a forward exchange rate.

Fundamental Analysis

A trading approach that evaluates economic, political, and financial data to predict market movements.

Futures Contract

A standardized agreement to buy or sell an asset at a specified price on a future date, typically traded on an exchange.

G5 (Group of Five)

The G5 refers to the five major industrialized nations: the United States, Germany, Japan, France, and the United Kingdom.

G7 (Group of Seven)

The G7 is a group of seven major industrialized nations: the United States, Germany, Japan, France, the United Kingdom, Canada, and Italy.

Gross Domestic Product (GDP)

The total economic output of a country within its borders over a given period.

GNP (Gross National Product)

Gross National Product (GNP) measures the total economic output of a country, including the value of goods and services produced domestically (GDP) plus income earned by residents from overseas investments or work abroad.

GTC (Good-Till-Cancelled)

A Good-Till-Cancelled (GTC) order is an instruction given to a broker to buy or sell an asset at a specified price, remaining active until it is either executed or manually canceled by the trader.

Hedge

A strategy used to reduce financial risk by holding offsetting positions.

High/Low

Refers to the highest and lowest prices at which an asset has been traded within a specific period, typically a trading day.

Inflation

A macroeconomic condition characterized by a sustained increase in the prices of goods and services, reducing the purchasing power of a currency.

Initial Margin

The minimum amount required to open a leveraged position.

Interbank Rates

Exchange rates at which large banks trade currencies among themselves.

Kiwi

A commonly used term in the forex market referring to the New Zealand Dollar (NZD).

Leading Indicators

Economic variables that help forecast future economic activity by reflecting trends before the broader economy begins to shift.

Leverage

The ratio between the total value of a trading position and the required security deposit. It allows traders to control a larger position with a smaller initial capital outlay.

Libor – London Inter-Bank Offered Rate

The London Inter-Bank Offered Rate. Large international banks use LIBOR when borrowing from another bank.

Liquidation

The closing of an existing position through the execution of an offsetting transaction.

Liquidity

The ease with which an asset can be bought or sold in the market without significantly impacting its price.

Long Position

A trading position where a trader buys an asset with the expectation that its price will rise.

Loonie

A common nickname for the Canadian Dollar (CAD).

Lot

A standardized unit used to measure the volume of a trade.

Margin

The collateral required to open and maintain a leveraged trading position.

Market Maker

A financial institution or firm that provides bid and ask prices to facilitate trading.

Market Order

An order to buy or sell an asset at the best available price.

OCO – One Cancels the Other

A conditional order that links two separate orders, where the execution of one order automatically cancels the other.

Open Order

An order that is executed when the market reaches a specified price.

Open Position

An active trade that has not yet been closed by an equal and opposite transaction.

Options

A financial contract that grants the holder the right, but not the obligation, to buy or sell a specific asset at a predetermined price within a set time frame.

Order

An order is an instruction, from a client to a broker to trade. An order can be placed at a specific price or at the market price. Also, it can be good until filled or until close of business.

Overnight Position

A trade that remains open beyond the current trading day and carries over to the next business day.

Pips (Points)

The smallest unit of price movement in Forex trading, typically 0.0001 for most currency pairs.

Position

A trading stance represented by buying or selling an asset.

Premium

In the currency markets, it is the amount of points added to the spot price to determine a forward or futures price.

Profit/Loss (P&L)

The total outcome of trading activities, including realized gains or losses from closed positions and unrealized gains or losses from open positions marked to market.

Quote

An indicative market price displaying the highest bid and/or lowest ask price available for a security at a given moment.

Rally

A recovery in price after a period of decline.

Rate

The exchange price of one currency relative to another.

Repo – Re-purchase

A financial transaction where an asset is sold with an agreement to repurchase it at a predetermined price on a specified future date, commonly used in short-term lending markets.

Resistance

A level in technical analysis where an asset’s price repeatedly struggles to rise above.

Risk Management

The process of identifying, assessing, and implementing strategies to minimize potential losses in trading.

Roll-Over

The extension of a settlement date for an open trade position to the another trading day. This process incurs a cost or credit based on the interest rate differential between the two currencies involved in the trade.

Settlement

The process of finalizing a trade by recording it in the accounts of both parties. In currency trading, settlement may involve the actual exchange of currencies or simply the adjustment of account balances without physical delivery.

Short Position

Selling an asset without owning it, with the intention of buying it back at a lower price in the future.

Spot

A transaction that is agreed upon immediately, with the actual exchange of funds typically occurring within two business days.

Spot Price

The current market price of an asset at a given moment, with settlement typically occurring within two business days.

Spread

The difference between the bid and ask price, representing the cost of trading.

Stop Loss Order

An order set to automatically close a position at a predefined loss level to limit risk.

Support Levels

A concept in technical analysis that identifies a price level where a declining asset tends to find buying interest, preventing further decline. It acts as a price floor where demand may increase.

Swap

Is the interest applied—either added or deducted—when a position remains open overnight, as indicated on the Trading Platform.

Technical Analysis

A method of forecasting price movements based on historical data, charts, and trends.

Tick

The smallest possible price movement in a financial instrument, either up or down.

Tomorrow Next (Tom/Next)

The simultaneous purchase and sale of a currency, rolling the settlement to the next business day.

Two Way Price

A quoted price that includes both the bid (buy) and ask (sell) rates for a forex transaction.

US Prime Rate

The interest rate that U.S. banks charge their most creditworthy corporate clients.

Value Date

The agreed-upon date when a financial transaction is settled, typically two business days forward for spot currency trades. Also referred to as the maturity date.

Volatility

A measure of how much an asset’s price fluctuates over time, often linked to risk levels.

Volume

The total number or value of securities traded within a given timeframe, reflecting market activity and liquidity.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

We need a few moments to check your documents. Please do not exit this window until we’ll finish. Thank you.

Most of our customers find it easier to upload these documents using their mobile phones.

• Please enter your mobile phone number and click on the “Send” button.

• A text message has been sent to your mobile phone.

• Please click on the link you have received on the text message.

• Now you can start uploading your documents.

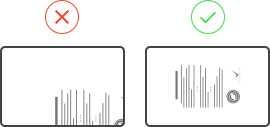

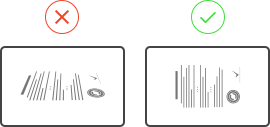

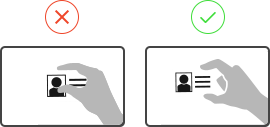

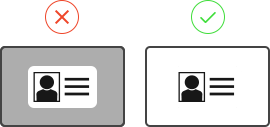

Do not obscure any part of the document

Do not obscure any part of the document

Do not obscure any part of the document

Do not obscure any part of the document

If you wish to fund your account via wire transfer, please contact your account manager or access our live chat to receive the appropriate banking details.

Please note that there is a minimum deposit of €500 for wire transfers.

In case of your transaction has been declined, you can get an instant help from our customer support.

Chat Now

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

You will be charged by VestoFX. This charge will appear on your statement as www.vestofx.com. Please feel free to contact us at +357 25 323 120. This website is operated by EVBX LTD, registration number: ΗΕ 408588 and registered at Spyrou Kyprianou 41 Avenue, Steratzias Court 2, 1st Floor, Flat 101, 4003, Mesa Geitonia, Limassol, Cyprus.

The Company is regulated by CySEC, License Number: 409/22.

Don’t have an account? Sign up

Like all investment opportunities, trading Forex and CFD involves risk of loss. Here at Vestofx, we provide you with access to an education centre, risk-management tools and a customer support team.

This section is open for clients only, please log in or sign up